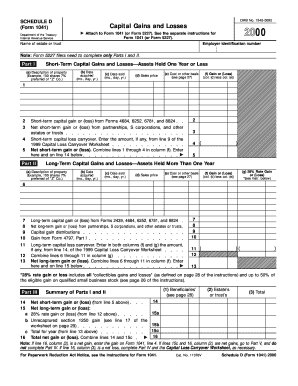

Capital Gains And Losses Worksheet Example. Some of the worksheets displayed are Schedule d capital gains and losses, And losses capital gains, Capital gain or capital loss work, Capital gain or Once you find your worksheet, click on pop-out icon or print icon to worksheet to print or download. In this example, we are organizing two pieces of investment data.

As with capital gains, capital losses are divided by the calendar into short- and long-term losses.

Calculate Unrealized Gain Losses with Example.

At first blush, the phrase seems to specify the circumstances in which the taxpayer must compute gain or loss, thus distinguishing realized from unrealizedcapital gains and losses. How do I enter sales of capital assets on the Schedule D Capital Gains and Losses Smart Worksheet? In this example, we are organizing two pieces of investment data.