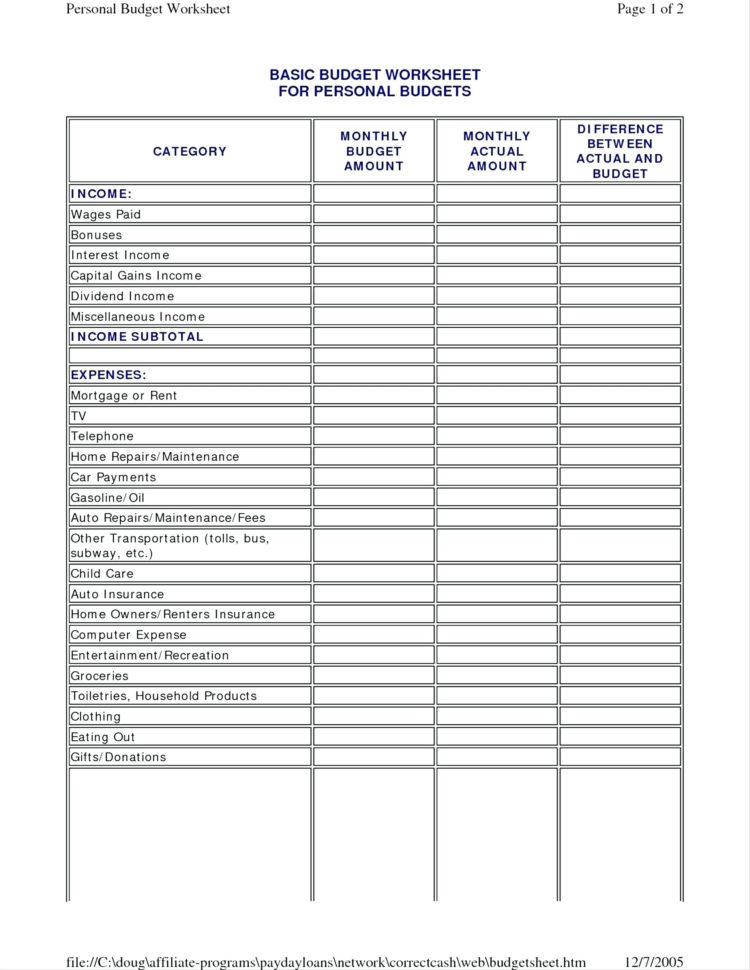

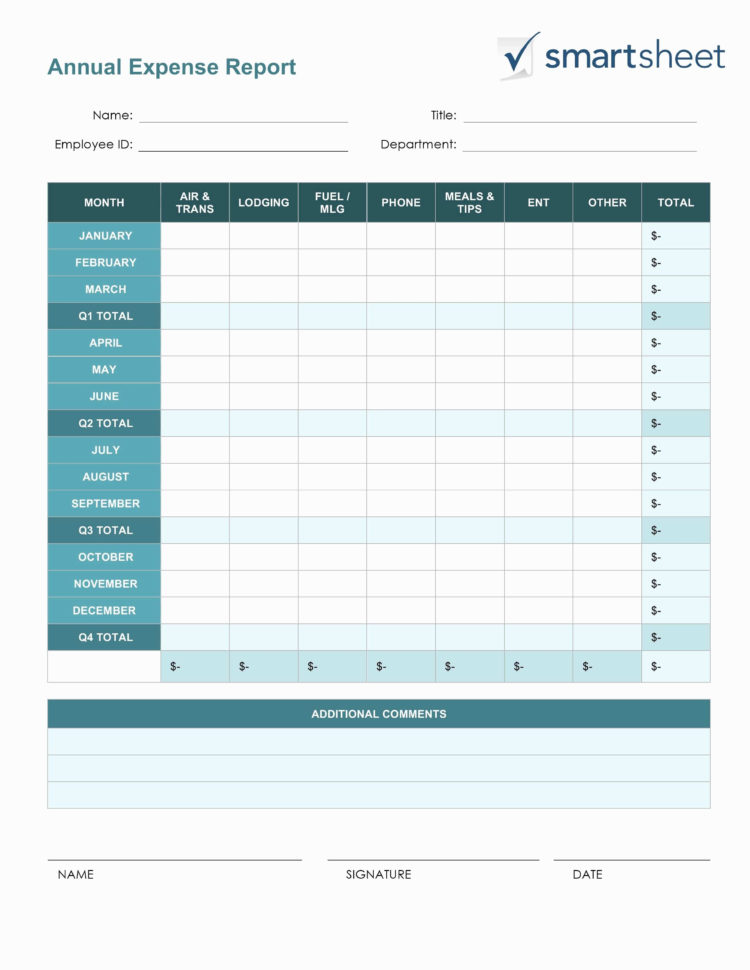

Tax Worksheet For Hair Stylist. Hair Stylist/Salon Tax Deduction Checklist Be sure to write off these acceptable deductions against your tax return to get the maximum refund: Hair Care Products & Tools (example: shampoo, conditioner, styling products, tools, supplies) Salon Furniture, Equipment & Space (example: chairs, stools, waiting room items) your tax obligations, stay in compliance with the law, and enjoy the benefits! Tax Tips & FREE Worksheet for Hair Stylists.

The correct form depends on filing status.

You can write off costs you incur while running your business to reduce the amount of tax you pay on your styling revenues.

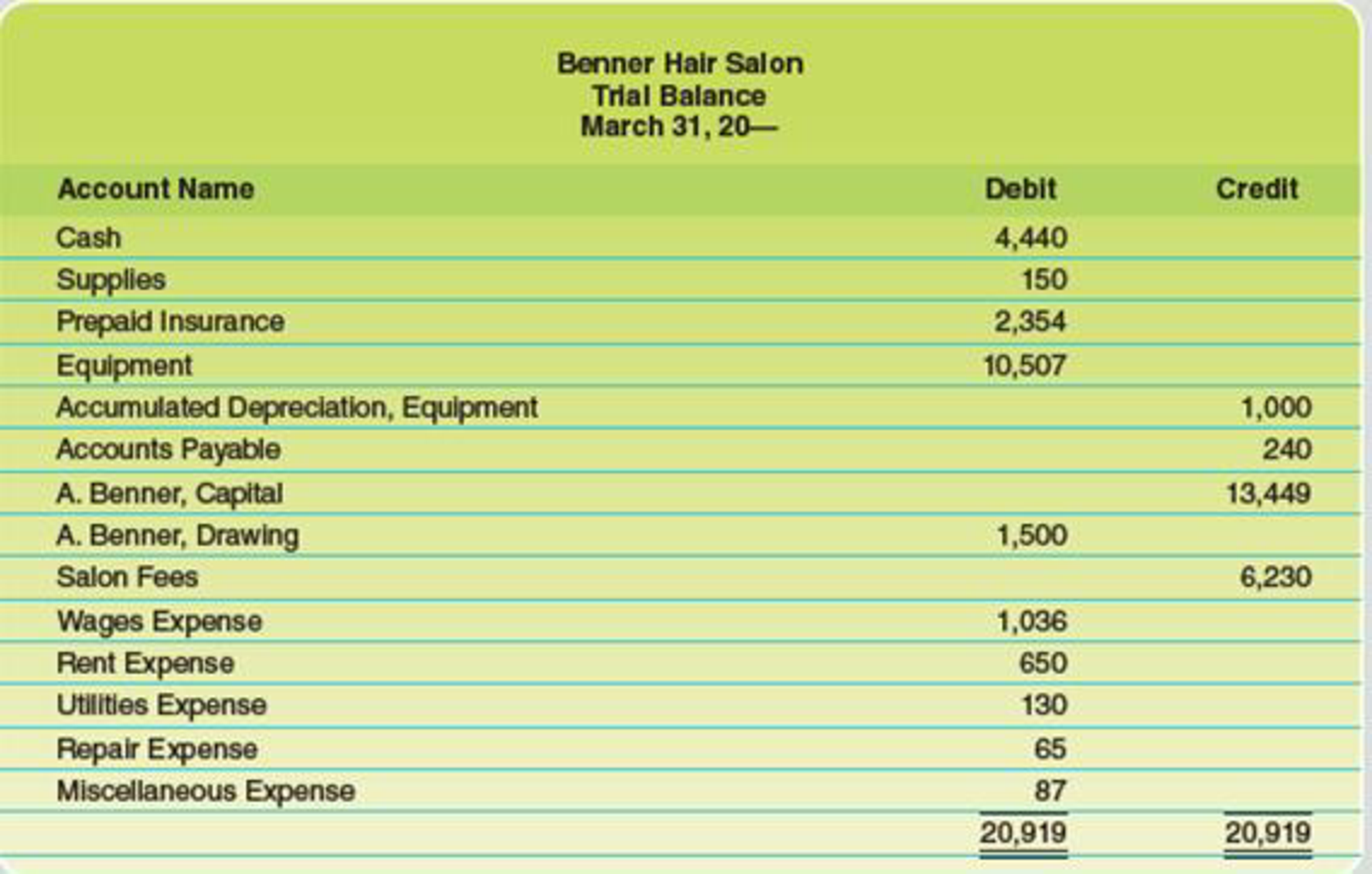

A self-employed hair stylist must follow tax rules for income received. Self-employed taxpayers report all of their income, including tips, on Schedule C, Profit or Loss from Business. Easy Salon accounting software for less than the price of a haircut!