State Tax Refund Worksheet Question C. This worksheet is used when a taxpayer was impacted by the alternative minimum tax in the previous year and under a few other circumstances. Here's a list of resources Check your Arkansas tax return by logging in the Arkansas Taxpayer Access Point page and then You will be able to check on your refund and the page also answers common questions about state.

Adding to the answers provided by Mark and Ai: Your state tax refund may not be fully taxable, if your total itemized deductions are close to your standard deduction.

If you are A renter. and Your total household The information you provide on your tax return is private under state law.

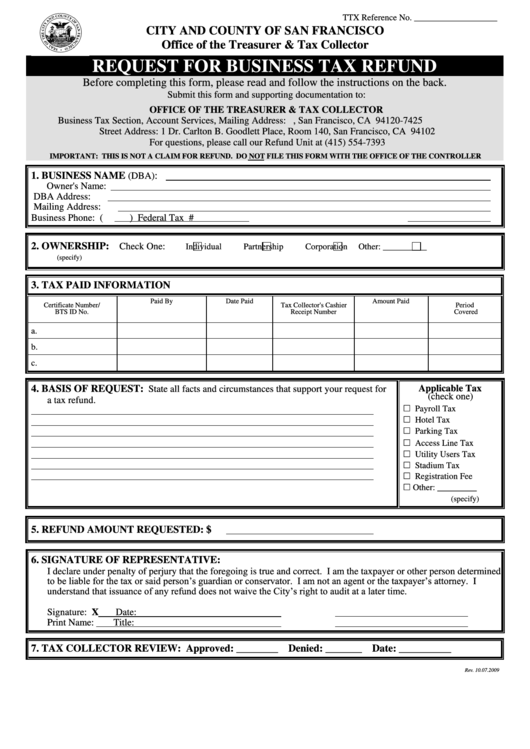

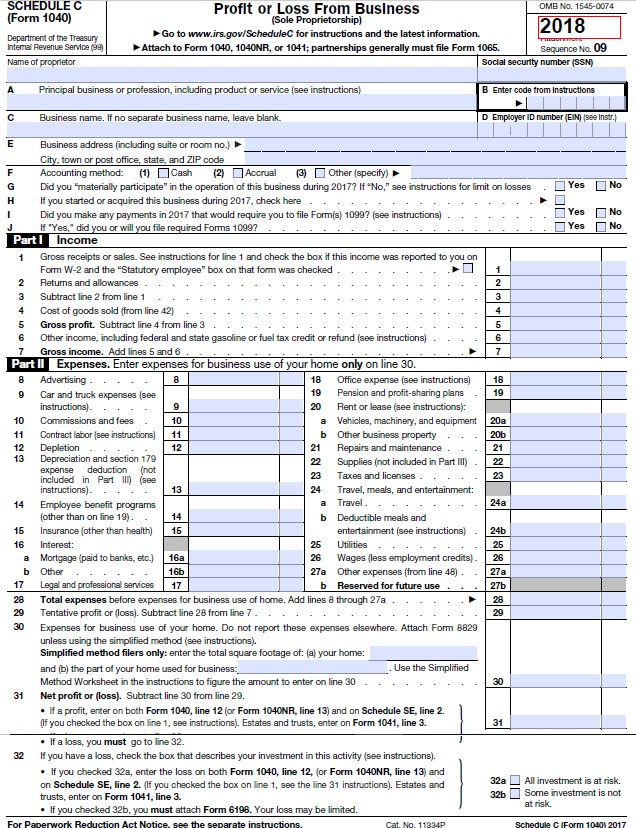

A tax return is the form you file annually that outlines your income, expenses, investments and other tax-related information. "It is literally the form you file You get a tax refund when you pay more taxes to your state government or the federal government - through payroll withholding, for example - than. Premier investment & rental property taxes. Use this service to see how to claim if you paid too much on income from a life or pension annuity. a redundancy payment. a Self Assessment tax return. interest from savings or PPI.

/tax_forms-56b810e45f9b5829f83d9167.jpg)